TLDR

We’ve seen a decent number of proposals putting forward strategies for governance and tokenization and infrastructure, but without grounding those into a shared sense of where/how value is being generated, by whom, for whom, and how that leads to shared benefits, these remain abstracted or only partially informed.

I believe establishing that common sense of value flows for Allo is essential, and that it will be possible to use that to contextualize and consider ideas that have come in via other proposals. Allo is presented on allo.capital as “a hybrid research org, software studio, and venture fund” so let’s begin by generating clarity regarding each of those value generating units as discrete spaces for value creation and then integrate and align further on that basis.

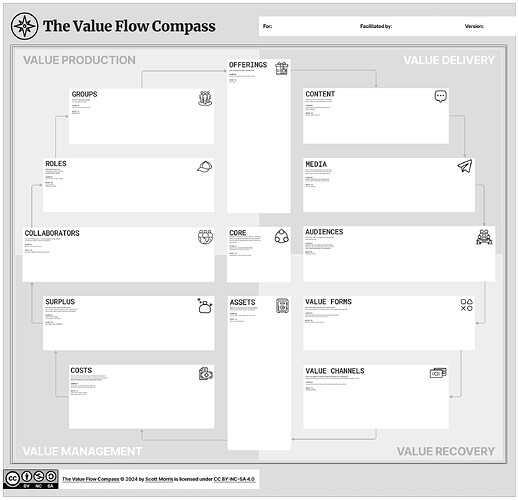

I’ll introduce a new canvas tool published last year called the “Value Flow Compass” which organizes what I believe are the essential elements of co-productive and cooperative processes into a map that can deliver on the above aspirations. I am happy to provide the tool and welcome others to experiment with it and offer feedback, and would be very happy to facilitate some workshops for the Allo community were there support for such an endeavor.

Sensemaking

There are huge amounts of money that want to be better utilized in the world of capital, but the people and institutions managing those funds need help making that happen. Allo seems inclined to service this market’s needs as it moves through developing understanding to requirements gathering to building and implementing. To my understanding:

- Allo seeks to support research on alternative and innovative means and methods of managing and allocating capital, developing market awareness and interest in moving towards implementation.

- Allo intends to incubate / accelerate relevant protocols, platforms, and products being built to meet the needs of the market as those become more specified.

- Finally, Allo (Capital) would then be well positioned to invest in select companies, tokens, etc. in support of building out a more capable array of mechanisms and other systems in its portfolio and greater ecosystem.

- In order to establish credibility and pursue these aims, Allo has invited adventurers (researchers, builders, etc) together to form some sort of guild-like organization that would provide them greater stability and support pursuing their dreams and helping what matters get funded in this context and beyond.

Allo me to Introduce the Value Flow Compass

Last year I published a new kind of canvas tool that helps with this challenge. It is similar in spirit to the Business Model Canvas many have encountered over the years as entrepreneurs, but it’s designed more with a mind for DAOs and other organizations that tend to operate on a more open basis. I present it here as a part of this RFP because I believe it might help us organize our collective thinking around Allo’s operationalization and token economics. It is less about providing answers about the design questions posed by the competition and more about presenting what I believe to be a core set of practical questions which can/should be answered for each of Allo’s key value generating activities as a critical step in the direction of designing a DAO that integrates across them.

Four Quadrants; Thirteen Fields

Value Production: This quadrant focuses on the elements of the organization involved in coproducing value, “Offerings” to the market.

The Collaborators field is the BY WHO; for collecting stakeholders involved in making the magic happen by contributing in whatever way.

The Roles field helps us identify (in Hats friendly format) where there are instances of permissioned privileges such as leadership roles, voting power, etc. and visualize which stakeholders play which roles.

The Groups field is for depicting the way the organization is broken up into sub-units, however they may be called; usually focused on common operational arenas, ad hoc groups for special projects, etc.

Offerings are where we itemize the specific goods and services we make available, both to external parties and to ourselves (think club goods).

Value Delivery: This quadrant is focused on the ways the organization brings its Offerings to market “Audiences”.

The Messaging field is for seeing the instances of public/audience-specific facing content that are created to market the Offerings, making it easier to find them and archive them as might be necessary.

The Media field is for curating the various instances of the brand such as the website, social media profiles, and community chat groups; anywhere relationships with Audiences are maintained.

The Audiences field is the FOR WHO; curating the types of people who might/do benefit from the Offerings, and what is known about their needs, interests, etc.

Value Recovery: This quadrant is focused on the various ways the Audiences contribute value in turn,

Value Forms include both monetary and non-monetary contributions (e.g. membership applications, votes, etc.) Audiences contribute as a form of general support or pay in exchange for Offerings.

Value Channels are the payment networks and relevant conversion services that might be utilized as the Value Forms flow from Audiences to the organization’s accounts / wallets.

Assets is where we map where shared resources can be found and tracked.

Value Management: This quadrant is focused on how we govern and utilize the Assets available.

The Costs field is for collecting the contributions made by Collaborators which are to be compensated or reimbursed; either presently or in the future.

The Surplus field is where commitments towards public goods, project oriented funding pools, benefits for Collaborators, Patronage, etc. can be visualized and tracked. [Presumably the default surplus allocation would be either to Collaborators or reinvestment in the venture, organization, DAO, etc.]

Finally, the Core field is where we collect essential documentation regarding the organization’s legal status, culture, agreements, etc. The next iteration of the canvas will develop this field further.

Next Steps

- Create Value Flow Compasses for Allo’s key functional wings

- Map out what we sense/know for each, and identify where there are unaddressed issues and other questions regarding the operational, governance, and technical plans for the immediate and long term.

- Identify key strategies, infrastructure suggestions, etc. in proposals and situate those on the VFC canvases where they fit (when possible) so they can be considered in context.

- Proceed systematically through each to discuss and align on various configurations / considerations.

- Move forward together in relatively high confidence knowing due consideration has been given to respective stakeholders and how everything integrates into a system we can all see more clearly.

- Lose our chains